All Categories

Featured

Table of Contents

This supplies the policy proprietor dividend choices. Dividend options in the context of life insurance policy describe just how policyholders can select to make use of the dividends produced by their entire life insurance coverage plans. Rewards are not guaranteed, nevertheless, Canada Life for example, which is the earliest life insurance firm in Canada, has not missed out on a reward payment considering that they initially developed a whole life policy in the 1830's prior to Canada was even a country! Right here are the usual returns options readily available:: With this choice, the policyholder makes use of the rewards to acquire extra paid-up life insurance policy protection.

This is only suggested in case where the fatality advantage is really vital to the policy owner. The added cost of insurance policy for the enhanced coverage will certainly reduce the cash money value, thus not suitable under limitless financial where cash money worth dictates just how much one can borrow. It is necessary to note that the accessibility of reward choices may differ depending on the insurance provider and the specific policy.

There are wonderful advantages for infinite banking, there are some things that you should think about prior to getting right into infinite banking. There are also some cons to limitless banking and it might not appropriate for somebody that is looking for budget friendly term life insurance, or if a person is checking into purchasing life insurance coverage solely to shield their household in case of their death.

It's vital to understand both the advantages and constraints of this economic approach before making a decision if it's right for you. Intricacy: Limitless financial can be complex, and it is very important to comprehend the details of exactly how an entire life insurance policy works and just how plan lendings are structured. It is very important to appropriately set-up the life insurance plan to maximize boundless financial to its complete potential.

What do I need to get started with Cash Value Leveraging?

This can be especially problematic for individuals that depend on the survivor benefit to give for their enjoyed ones (Bank on yourself). Generally, limitless banking can be a valuable financial approach for those that comprehend the details of exactly how it works and want to approve the costs and constraints linked with this financial investment

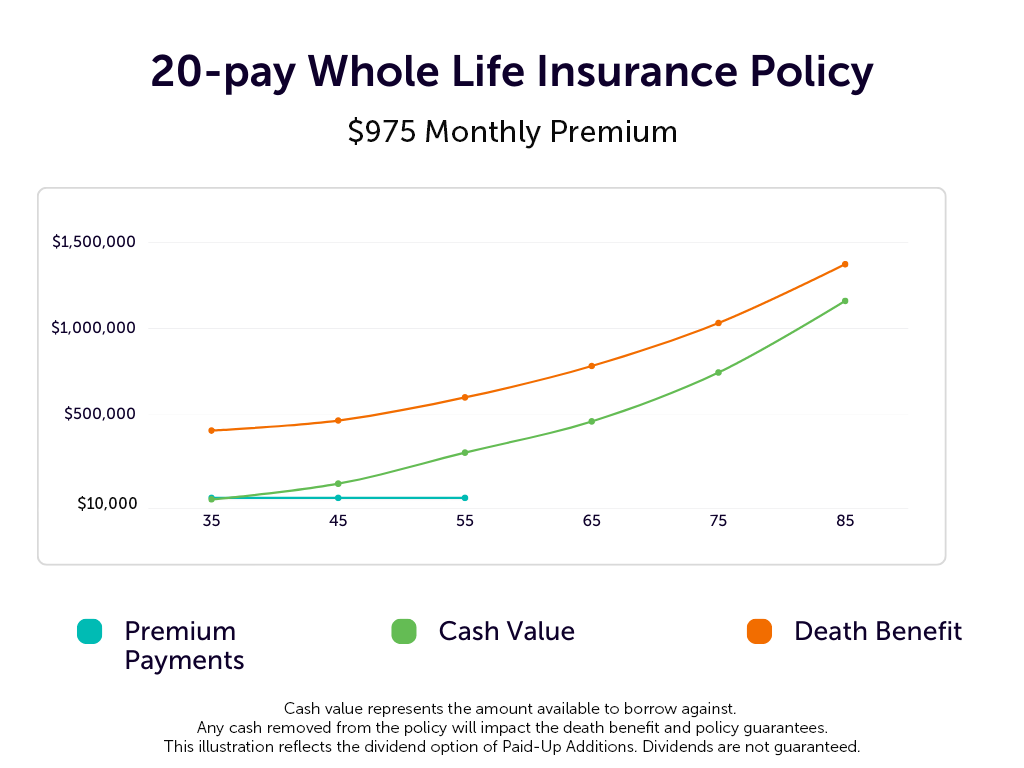

Choose the "wealth" choice rather than the "estate" alternative. The majority of firms have 2 various types of Whole Life strategies. Choose the one with greater cash values earlier on. Over the training course of a number of years, you add a significant quantity of money to the policy to accumulate the money value.

You're basically providing money to yourself, and you settle the funding with time, usually with passion. As you pay back the financing, the money value of the plan is restored, enabling you to borrow against it once more in the future. Upon death, the fatality advantage is lowered by any type of exceptional lendings, yet any kind of remaining fatality benefit is paid tax-free to the beneficiaries.

Can anyone benefit from Policy Loan Strategy?

Time Horizon Danger: If the policyholder determines to cancel the policy early, the cash abandonment values may be substantially lower than later years of the policy. It is suggested that when exploring this strategy that has a mid to long-term time perspective. Taxes: The insurance policy holder might incur tax repercussions on the car loans, returns, and death advantage settlements obtained from the policy.

Complexity: Unlimited banking can be complicated, and it is very important to recognize the information of the plan and the cash money build-up part prior to making any type of financial investment decisions. Infinite Financial in Canada is a legitimate economic technique, not a rip-off. Infinite Financial is a concept that was created by Nelson Nash in the United States, and it has actually considering that been adapted and implemented by economic professionals in Canada and various other countries.

Plan financings or withdrawals that do not surpass the adjusted price basis of the policy are taken into consideration to be tax-free. Nevertheless, if policy car loans or withdrawals exceed the modified expense basis, the excess amount might undergo taxes. It is necessary to note that the tax advantages of Infinite Financial might undergo alter based upon changes to tax laws and laws in Canada.

The threats of Infinite Banking include the potential for policy financings to minimize the survivor benefit of the policy and the possibility that the policy might not carry out as expected. Infinite Financial may not be the ideal strategy for everyone. It is necessary to carefully consider the prices and possible returns of joining an Infinite Financial program, along with to completely study and recognize the involved threats.

How do I track my growth with Policy Loans?

Infinite Banking is various from traditional financial because it allows the policyholder to be their own source of financing, as opposed to counting on typical financial institutions or loan providers. The insurance holder can access the cash money worth of the policy and use it to finance purchases or investments, without having to go via a conventional lending institution.

When many people require a finance, they request a credit line via a typical financial institution and pay that loan back, gradually, with passion. What if you could take a car loan from on your own? Suppose you could prevent the big financial institutions completely, be your own financial institution, and supply yourself with your own credit line? For doctors and other high-income income earners, this is feasible to do with infinite banking.

Below's a financial advisor's testimonial of unlimited financial and all the benefits and drawbacks entailed. Boundless banking is an individual banking approach developed by R. Nelson Nash. In his publication Becoming Your Own Lender, Nash discusses just how you can make use of a long-term life insurance coverage plan that constructs cash money value and pays dividends thus releasing on your own from needing to borrow cash from lending institutions and pay back high-interest fundings.

How do I track my growth with Infinite Banking In Life Insurance?

And while not everybody gets on board with the concept, it has actually tested numerous hundreds of individuals to reconsider just how they bank and exactly how they take finances. In between 2000 and 2008, Nash released 6 editions of the publication. To this day, economic advisors contemplate, method, and discuss the concept of boundless financial.

The limitless banking idea (or IBC) is a little bit more difficult than that. The basis of the boundless banking concept begins with irreversible life insurance policy. Boundless banking is not possible with a term life insurance coverage policy; you need to have an irreversible cash money worth life insurance policy plan. For the concept to function, you'll need one of the following: an entire life insurance policy plan a universal life insurance policy policy a variable global life insurance plan an indexed global life insurance policy policy If you pay greater than the called for month-to-month costs with long-term life insurance policy, the excess payments build up money value in a cash money account. Infinite Banking for retirement.

Yet with a dividend-paying life insurance coverage policy, you can grow your cash worth even quicker. One point that makes entire life insurance unique is gaining much more cash via returns. Expect you have a long-term life insurance plan with a shared insurer. Because situation, you will certainly be qualified to get component of the firm's revenues much like how investors in the firm receive rewards.

Table of Contents

Latest Posts

How To Be My Own Bank

Life Insurance Infinite Banking

Infinite Concept

More

Latest Posts

How To Be My Own Bank

Life Insurance Infinite Banking

Infinite Concept